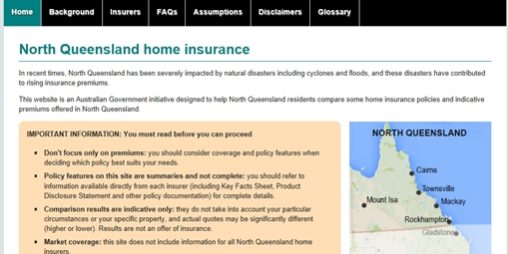

A NEW website to compare property insurance in North Queensland has gone live today and will be an important tool in increasing transparency in the market, says Leichhardt MP Warren Entsch.

“The website has been prepared on behalf of the Federal Government by the corporate regulator, the Australian Securities and Investments Commission, and can be accessed at www.nqhomeinsurance.gov.au,” Mr Entsch said.

“It’s very easy to use and means that homeowners can quickly compare information on which insurers are offering products in their locality, general policy features and indicative premium prices.

“There are 195 North Queensland locations included on the website, covering nearly 800 suburbs and towns north of Rockhampton, including coastal and inland regions.”

Mr Entsch said the website provides information about policies for stand-alone residential buildings, and contents for stand-alone and some strata-titled properties, offered by eight insurers (comprising 11 home insurance brands):

– Allianz

– ANZ (ANZ and OnePath brands)

– CommInsure

– IAG (NRMA brand)

– QBE

– RACQ

– Suncorp (AAMI, Apia and Suncorp brands)

– Westpac

– Information about policies offered by Youi will be available on the website in May 2015.

“It’s important that people realise that this is a tool to help with shopping around, and that they will still need to contact insurers for actual quotes specific to their circumstances and to purchase a policy,” Mr Entsch said.

“In most cases the final price will be different depending on a property’s individual characteristics, and in some cases – given we know the insurance companies don’t want to insure properties in some of the more remote and coastal areas – people might still not be able to access any cover.

“This will be disappointing but at least it will increase transparency about insurance offerings and means we can continue to put pressure on the insurers to offer a level of cover in all areas.

“In the meantime, we have also just announced that the Federal Government will invest a significant amount of money in carrying out feasibility studies on two models that will dramatically impact insurance premiums in Northern Australia ? the first being a mutual offering catastrophe cover, and the second being a catastrophe reinsurance pool.

“It’s now just 18 months since the election but we already have this new tool up and running, together with a commitment that the Government will provide support to whichever option is deemed the most viable as a result of the feasibility studies.

“It’s a very exciting time and I’m over the moon to be providing solutions to this ongoing issue.”

The website emphasises the importance of policy features appropriate to a consumer's circumstances when choosing home insurance, not just the premium.

Information about indicative premiums for Suncorp brands is available for approximately two thirds of the locations covered by the website; indicative premiums for Suncorp brands for the remaining locations will be available in due course.